Fintech startups are all about pushing the envelope, whether in technology or customer experience. Be that as it may, many forget that banks were the original “innovators.” Even now, a number of corporates and banks are engaging with disruptive tech in their own way, either by developing solutions in-house or engaging directly with external innovation centers.

“Open Innovation”

Open source is a popular concept, especially among programmers who see it as an excellent way to develop clean, tested and efficient code. The underlying tenant that makes this concept work is free and open access to source code, blueprints and other relevant documents.

Extrapolating the same concept onto the innovations sphere translates into stakeholders engaging with open-collaboration. At first, it may seem that the main requirement for the success of such an open structure would come in the form of real internal problems faced by corporations. That, however, is not the case. Given that information in today’s digital world travels faster than a buttered bullet, an intelligent analysis by someone in-tune with a particular industry is likely to reveal a basket of problems.

What really drives the success of such corporate motivated projects is an internal champion. Someone who is motivated by the problem at an intrinsic level, and possesses the drive to assist external players with developing an effective solution.

In essence, these internal champions ought to be avid supporters of an “open innovation” model and have at their disposal means (mostly, data) needed to “test” various iterations of a product.

All this may seem like a unfathomable task, but it is heartening to know that some banks have already created world-class programs that aim to accomplish everything mentioned above.

– Barclay’s Rise: Powered by Techstars, a 13-week programme that helps businesses grow by connecting them with expertise, solutions, networks and opportunities internationally.

– BNP Paribas: The “Innov&Connect” programme is dedicated to connecting startups and midsize businesses, along with supporting their growth. The group has 15 Innovation Centers that provide specialized services to startups throughout their life-cycle.

– Societe Generale: Launched by the European Business Services, called the Catalyst, originated in India and later extrapolated to the Bucharest (Romania) center. The program strives to test new tech such as artificial intelligence, machine learning and blockchain while working with local startups, during a 10-week agile driven program focused on providing teams with mentorship and business expertise.

In Montreal, we are starting to see some of these progressive initiatives take hold. Last year, FormFintech was fortunate to participate in two community style multi-week “hackathons” to develop innovative solutions.

The first, Cooperathon, a 2-month long initiative led by Desjardins where startups in fintech, healthtech, smart cities and edtech worked on developing solutions to solve corporate problems.

The Second, Formathon, led by FormFintech successfully managed to co-innovate with four large organizations during its 3-week long Formathon and District 3’s Innovations program. Again, the goal was to solve problems presented by corporates.

Internally Developed Fintech

Many companies are also leading innovations in a different manner. Deloitte is one such example, as was demonstrated by their Deloitte Technozone at the Forum Fintech in October 2017.

According to Umberto Delucilla, Partner and Chief Innovation Officer (Quebec) at Deloitte and one of the masterminds behind the Deloitte Techno Zone concept, “the technozone was about giving participants an experiential learning process. People don’t understand tech by listening to someone on the stage, but by playing and engaging with it:”

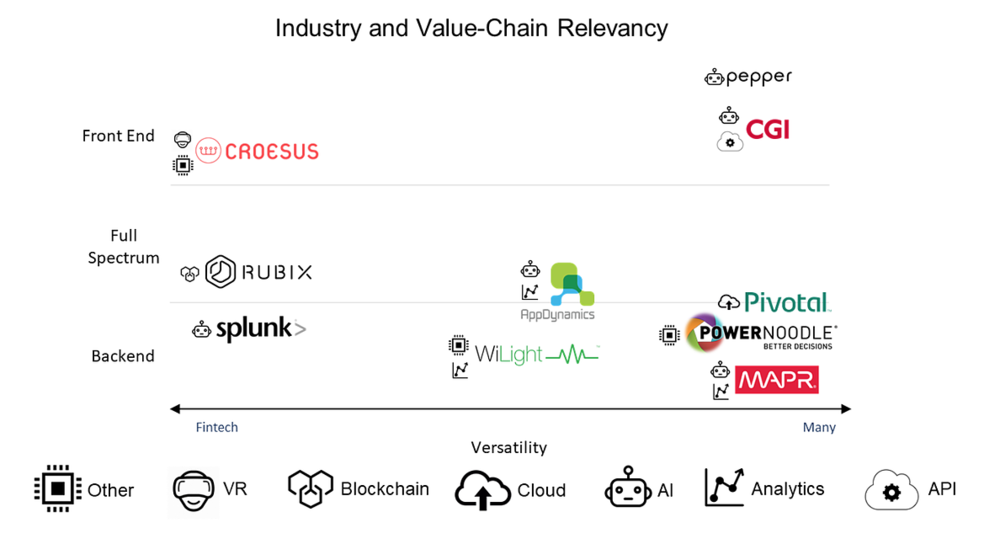

In this space at the Forum, there were a wide range of companies showcasing their technology, with variances in terms of presentation layers (frontend, backend), the versatility ( fintech, many industries) and technologies used. The matrix below presents the positioning of all corporations based on these 3 categories.

Figure1: Industry and Value-chain positioning matrix

If this matrix interests you, learning more about each of these solutions would be an even enticing prospect. In the next section, we will delve into each of the contributor’s offerings and demonstrations used to provide participants with an experiential learning environment.

Engage to Learn

In the first part of this article series, we provided a detailed explanation of “open innovations” model employed by corporates in the banking sector, along with a teaser matrix of the different startups present at 2017’s Deloitte Technozone.

Figure 2: One could play around with different types of technologies at the Deloitte Techno Zone

Here, we will explain the offerings of each of the contributors and their respective demonstrations. Contrary to what one might expect, contributors were a mixed bag of old and new establishments.

WiLight

An energy transmitter that can be placed under any table to charge devices such as cell phones, laptops, iPads etc. Behind the scenes, WiLIght is more than just a charging station. All touchpoints feed into a sophisticated backend that collects data on space and movement of users, analytics that are especially useful for real estate and employee management.

Deloitte, Rubix

Showcased their employee rewards system, built on blockchain. Users can receive and transfer points, along with competing against each other. Points earned are redeemable against actual merchandise. The system is updated in real-time, both on the frontend and backend, eliminating the need for batch recognition systems.

Deloitte, AI Chatbots

Demonstrations showcased how clients could conduct banking and insurance transactions over a chatbot based on natural language processing. The bot is intelligent enough to understand context. For instance, if a user said “I lost my wallet”, the system responded by asking the user which credit/debit cards they wanted to block.

Pepper, Deloitte: AI Driven Humanoid

One of the main attractions of the event, a 62-pound humanoid robot with touch sensors on the top of its head and hands. Pepper could recognize emotions based on a person’s facial expression and their voice tone. The bot can be used for anything from accessing the internet to obtaining a car loan.

Video includes: WiLight (0:06), Deloitte Rubix (4:15), Deloitte AI Chatbots (6:15), Pepper Deloitte (7:50)

Croesus: Gamified VR-Based Asset Management

Croesus is pushing the use of virtual-reality-based gamification for portfolio management. Participants could walk into the both, put on a pair of VR glasses and make financial decisions while sitting on a virtual roller-coaster. When the game finished, all decisions went into a portfolio management application and were processed to provide information such as total value of portfolio, individual transactions value and high score.

Video includes: Umberto Delucilla (0:00) & Croesus Gamified VR Based Asset Management (2:55)

Croesus also showcased an augmented reality data visualization software. By wearing connected glasses, one could project graphs on real-life objects. Additionally, objects (e.g. graphs) could be controlled through hand gestures, similar to the futuristic film Minority Report starring Tom Cruise.

Microsoft, Facial Recognition System

Microsoft’s booth was all about vision services ie. the use of artificial intelligence to detect a person’s attributes such as age, race, gender and even emotions. Technology that can be used in any industry where cameras are already installed, be it improved security at ATMs or calculating customer demographics and their emotional journey while visiting a retail banking outlet.

Video includes: Microsoft Azure (0:05) & Auvenir (5:03)

Powernoodle, Cloud Software for Better Decision-Making

Leveraging best-practices in cognitive psychology and behavioral science to improve the decision-making process within an organization (read: digital design thinking). A gamified process to extract the wisdom of the crowd and visually illustrate results to guide organizations in their decision making process. Decisions are tracked end-to-end, along with being completely auditable. In the long-run, firms can use this historical data for post-mortem and ultimately improve the decision-making process.

Video includes: PowerNoodle

MAPR: Converged Data Platform

MAPR’s team used toy cars on a race track to illustrate the efficiency of their data collection process. The system collected data (on speed, turns, distance etc.) which was processed real-time to identify trends and patterns. Such an analytics-rich framework can be applied to any industry, and can be combined with legacy systems and historical data to provide useful insights

Splunk: Real-time AI

A screen with flashing numbers and colors, at first glance, one would mistake this platform for a trading screen. However, Splunk is focused on a very different niche – analyzing physical endpoints of credit card transactions to detect fraud. Real-time AI-system would alert users on the event of suspicious transactions. For instance, consecutive credit card purchases conducted in a short timeframe at two different locations that are miles apart.

Video includes: MAPR (0:05) & Splunk (3:25)

CGI, AI Based Conversational Avatar

An AI-based conversational avatar that can be used with any business that has an open API backend. Potential customers talk to an on-screen avatar or use the old-fashioned method of typing-in their conversations. Following such interaction, the avatar provides information on how users can better manage their portfolios or plan for their retirement. The system is intelligent enough to identify attributes such as a person’s age, leading to faster logins and a frictionless user-experience.

AppDynamics/Cisco, Application Performance Monitoring & Management

A platform that breaks down barriers of communication between IT and business units. More specifically, identifying problems with the source code in real-time, followed by providing users with reports that match relevant code to associated business processes and KPIs. For instance, business units are notified when certain anomalous KPI changes take place (i.e. a sudden drop in revenues or customers). A handy system then allows business units to approach responsible IT departments within their organization.

Video includes: CGI (0:05) & AppDynamics (3:55)

IBM, Chatbot & AI

Watson AI is capable of chatbots 2.0, making product recommendations based on a person’s intent. The end result is an interactive AI-based experience for users (i.e. a chatbot that understands your needs through a more human conversation), with the merchant receiving rich data detailing the customer’s preferences. In the words of IBM’s booth coordinators “Instead of clicks on a website, banks gain data on actual customer interaction.”

Another Watson AI application illustrated how to identify illegal trades such as those based on collusion. A highly comprehensive platform analyzes everything from phone and email interactions on the trading floor to trading style and history of trades. Trades are flagged real-time for compliance managers, who can then dig deeper into potential issues.

Pivotal, Cloud Foundry

They conducted a 3-hour workshop showcasing the power of their cloud foundry. A cloud foundry allows teams to produce software in short cycles and supports full application development cycle from initial development to deployment, including all testing phases in the middle. At this workshop, participants with or without technical knowledge, had the opportunity to develop and deploy a cloud-based trading platform.

Closing Remarks

Innovations models, internal or external, are gaining traction and have already developed a strong foothold in some parts of the world. Meanwhile, startups are doing what they do best i.e. innovating in ways that no one could have imagined before. In Montreal, to further push the development of open innovation, two new editions of the Formathon (applications now open for 2018) and Cooperathon are scheduled for this year.

Last but not least, we are confident that Finance Montreal and Deloitte will bring their A-game to makethis year’s Fintech Forum even more exciting, educational and innovative.