Montreal – January 19, 2021

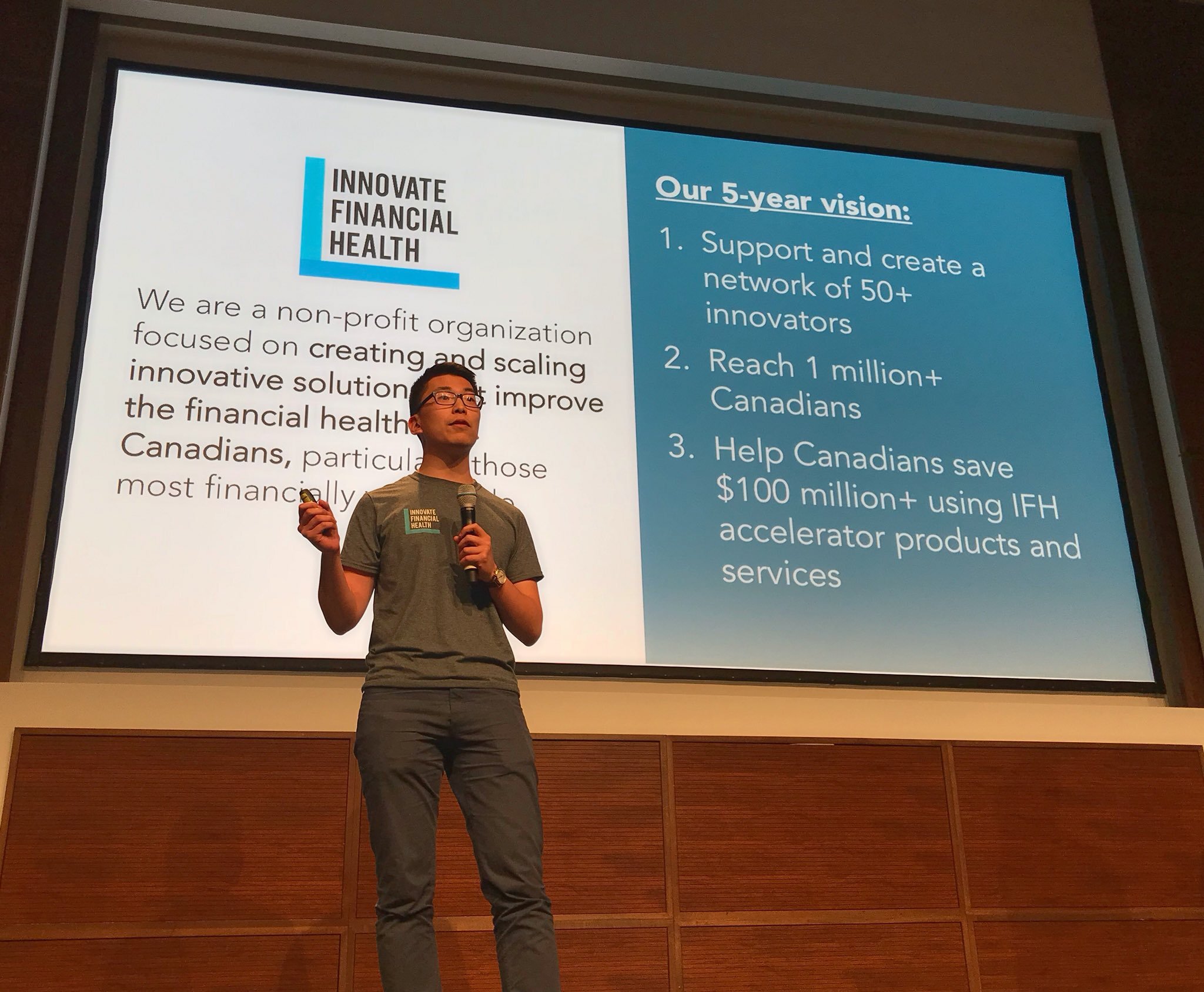

Innovate Financial Health (IFH), a non-profit based out of Toronto that supports fintechs focused on improving the financial lives of Canadians, has been acquired by Fintech Cadence, Canada’s fintech hub.

Founded in 2017 in Montreal, Quebec, Fintech Cadence is on a mission to develop Canada’s future fintech leaders. Since their creation, they have not only launched the first fintech-focused incubator but have grown to include a 12-week Fintech Certificate and the Formathon, Canada’s biggest fintech competition. To date, Fintech Cadence has engaged with over 150 teams and supported over 100 early-stage startups who have collectively raised $3.5M+ and created 300+ jobs in Canada.

The acquisition of Toronto-based IFH recognizes the gap in support for impact-driven fintech companies. The move enables Fintech Cadence to better support the growth and acceleration of startups in their pipeline tackling some of the most pressing barriers to financial health facing Canadians today. The organization believes that this will be an important first step towards increased collaboration between the Quebec and Ontario ecosystems towards the common goal of making Canada a world leader in financial technology. This move follows Fintech Cadence’s strategy to expand across Canada in order to serve early-stage fintech founders and support their growth.

“Fintech Cadence started 4 years ago with the aim of developing the fintech ecosystem from the grassroots level. Now, we are at a point where we need to not only elevate Montreal or Toronto but bring the fintech industry across Canada together” says Layial El-Hadi, Executive Director at Fintech Cadence.

Innovate Financial Health’s flagship program is the IFH Lab, a 6-month program that provides selected startups with access to capital, mentors, and workshops specific to the challenges that mission-driven fintechs face. Their first cohort ran from January to June 2020 and included four startups, altruWisdom, PolicyMe, Quber, and ZayZoon. Since the start of the program, these companies have raised $6.8 million+ in additional capital, added 20+ team members, and most importantly have helped thousands of Canadians improve their financial lives – from understanding their financial situations based on specific life events to accessing affordable life insurance to building emergency funds, to avoiding costly payday loans and overdraft fees.

“We started Innovate Financial Health because we believe that technology can play a critical role in addressing the real challenges that millions of Canadians face each and every day in managing their money. Even prior to this global pandemic, over half of Canadians reported spending more than or equal to their income and 38% were unable to pay all their bills on time and in full. Almost half report losing sleep at night because of money worries while 36% report losing productivity at work. Fintech Cadence is an expert in the development of early-stage fintechs and has deep partnerships across the ecosystem. At IFH, we have been working to solve the financial troubles of Canadians, and joining Fintech Cadence enables us to not only accelerate that mission but increase our reach” says IFH founder Elvis Wong.

Elvis now joins Fintech Cadence as their Director of Financial Health and will be tasked with leading Fintech Cadence’s financial health efforts as well as connecting the ecosystem with other players throughout Canada and beyond. The next cohort of the IFH Lab will run from May to October 2021 and applications are open. Startups can indicate their interest in applying here. The team is also pleased to announce that JPMorgan Chase will be the Champion Partner for IFH Lab.

“Technology offers tremendous potential to expand access to safe, affordable financial products and services for consumers in communities across a range of incomes, languages, and geographies. Together, Fintech Cadence and Innovate Financial Health can grow Canada’s fintech sector to better meet the needs of Canadians struggling to weather economic shocks and seeking to build long-term financial health” says Owen Washburn, Vice President, Global Philanthropy at JPMorgan Chase.

For more information on Fintech Cadence, visit www.fintechcadence.com

For more information on IFH Lab, visit www.fintechcadence.com/ifhlab

For press inquiries, contact Nicholas Belliveau at [email protected]