F8th winning the CFS Pitch Battle of Day 2.

By Molly Willats

Members of the Fintech Cadence team made their way to Toronto last week to take part in the Canadian Fintech Summit (CFS). FC’s Fearless Leader, Executive Director Layial El-Hadi and Peerless Head of Partnership Nina-Mae Proulx were excited not only to see so many colleagues from across the Canadian ecosystem at one of our first in-person events in two years, but also for the chance to hang out (and concoct plans) with our Toronto-based teammates. This year’s CFS was packed full of interesting insights, exciting startups, and happy connections. While there’s far too much learning to cover in one blog post, we wanted to share some of our personal highlights with you!

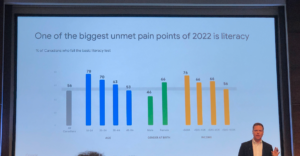

78% of Canadians would fail a financial literacy test.

- Marshall Shefall, Managing Director at Google

On day one, Nina took point, kicking things off with the opening keynote from Managing Director at Google, Marshall Shefall about how consumer behaviour and needs in financial services have changed in an era of rapid digital disruption. We learned that after health, finance was the second largest search category in 2020-2022. We don’t find this surprising, do you? Health and finance not only have incredible potential to disrupt, and change our lives, they are also closely connected. The pandemic has certainly highlighted both the link between financial stress and poorer health outcomes, and how individual and public health can have drastic impacts on short and long term financial outcomes.

Marshall also shared that 78% of Canadians would fail a financial literacy test! This highlights a major pain point for consumers, and missed opportunity; as Marshall touched on, addressing this gap can drive growth. An informed customer will be more likely to use a suite of products and services to meet not only their basic financial needs, but also their financial aspirations. On the other hand, we find this to be especially pressing in the context of a rapidly growing ecosystem of consumer fintech. According to Marshall, Canadians are less brand loyal than ever (a pretty interesting trend to see developing in Canada, where banking brand loyalty has been a defining feature for…well, ever). Covid seems to have been a driving factor here too, with branded searches for the top 2 challengers surpassing those for the big 5 banks beginning January 2020. (On a related note, Framework Ventures predicted that one neobank will become a legitimate challenger in the western world in the next 12 months – SoFi, Robinhood, N26, Chime, or Revolut).

This got us thinking:

What does it mean for consumers to have more choices when it comes to financial products and services if there is a significant literacy gap? How do we make sure the fintech ecosystem is addressing this gap and building products that help consumers make informed choices about their financial futures?

Insert shameless plug for our IFH Lab program where we’re doing just that!

Oh and Fintech Cadence alumn Boss Insights took to the stage at the conference’s first pitch battle competition!

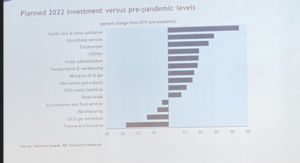

Layial tagged in for Day 2, where we kicked it off with a keynote from Senior VP & Chief Economist at RBC Craig Wright examining the two-way relationship between labour force growth and economic productivity. Among assessments of future development of Canada’s economy, Wright went over the importance of investment as a driving force for a country’s productivity level. He also addressed that in order for Canada to sustain and grow its economy, it is key to increase the country’s labour force and its productivity levels, and the latter is where technological development and innovation can play a big role.

The Pitch Battle was next, once again featuring a FC alumn F8th (who went on to win that day’s battle!). Following this exciting face-off of up and coming startups, speakers Anya Klimbovskaia (Co-founder & COO, Divesio) and Anouk Robillard (VP Corporate Strategy & Innovation, BDC) dove into a topic that our team is really passionate about in their talk Bridging the Gap Between Diversity on Paper and Inclusion in Practice.

“Collecting data helps administer the right medicine to the problem, versus trying to find solutions that don’t address the real problem.”

- Anya Klimbovskaia, Co-Founder & COO at Diversio

Anya shared how “collecting data helps administer the right medicine to the problem, versus trying to find solutions that don’t address the real problem,” highlighting the importance of data-driven decision making in designing DEI strategies.

In their closing remarks, Anya and Anouk encouraged guests to collect that data, even if it feels daunting – barriers to access and DEI are not always obvious, it’s critical that we actively look for them. This is something we have been making a more concerted effort to address at Fintech Cadence, introducing demographic questions into event registration, conducting exit interviews with our startups when they complete a program, and partnering with organizations like DMZ Black Entrepreneurship initiatives and Queertech to grow our knowledge around designing programs with DEI in mind.

On the other end of the data-driven spectrum, Alex Scott of Borealis AI offered a sobering perspective on one area of fintech that’s become a bit of a buzzword.

“Not every problem can be solved with AI. Why? AI is great at interpolation but very bad at extrapolation. Some business goals can’t be translated into a Machine Learning objective - not all problems have mathematical solutions.”

Alex Scott, Borealis AI

A common criticism of AI driven solutions is that they can reinforce bias because of this very characteristic. We’d love to hear your thoughts on the future of AI, its limitations and its strengths in fintech. Leave a comment below or @ us on LinkedIn or Twitter linking this blog and share your thoughts!

To close it off

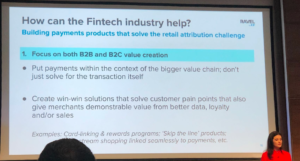

There’s so much more we could share, but we’ll close this recap with a roundup of random thoughts (and advice) about the future of FI and fintech startup collaboration that stood out:

- From Day 1’s talk on How Startup & Corporate Collaboration is the Key to Your Success, there’s a shift from FIs asking for an NDA when working with startups to creating pilots, coaching and offering mentorship to move the needle. It looks like FIs are seeing the value that fintechs bring to the table, and the necessity of staying ahead of the curve on technology that is innovating and disrupting the sector.

- Canadian fintechs need to stop thinking small and start thinking globally!

- “The first recipe to success for fintech and FI partnerships – cool and well thought out on-boarding processes,” says Adam Nanjee, Managing Director of Canada Startups and Venture Capital at Microsoft. How can you expect a 50 person startup to work with a large conglomerate? You need a dedicated onboarding process!

- Investors in Canada need to stop saying “Maybe” and start giving startups clear yes or no answers, as well as explain what they need to get to yes (we couldn’t agree more Jan Arp!)

- And some solid advice for startups getting ready to pitch to an FI from Mike Dobbins, former RBC Chief Strategy and Corporate Development Officer, and Founder of RBC Ventures: “Put yourself in the shoes of the people you are calling. Think about what they are trying to work on and think about your pitch from that lens.”

We’d love to hear from you about your key takeaways from this year’s Canadian Fintech Summit. Leave a comment below, tweet us, or tag us on LinkedIn and tell us what you learned or what you would like to see at next year’s event!

If we didn’t get a chance to connect at the conference and you want to learn more about Fintech Cadence, feel free to reach out to info@fintechcadence.com!

Thank you to the CFS team for putting together this wonderful summit, see you at the next one!