On October 10th & 11th, the fifth Annual Fintech Forum, organized by Finance Montreal, was held at the Palais des congrès de Montréal. The event attracted close to 2,000 finance professionals and fintech enthusiasts. The highlight of the event, according to many, was the fintech pitch competition. Ten startups battled it out for not only $15K in prize money and in-kind services, but also for being crowned as the judges’ or crowd’s favorite.

The atmosphere was tense, yet filled with excitement. All entrepreneurs projected an uncanny sense of confidence, which came in-part due to the gruesome amount of prep-work that they all had put in for the pitch day.

Jan Arp, Director & Founder of FormFintech, was leading the pitch preparations. “We had six different VCs with over 100 years of investment experience (i.e. and over $1 billion in assets under management) donate their time to turn these presentations into performances. With only 3 weeks to prepare, the high quality of entrepreneurs selected was apparent, as each team found a way to come through in the clutch and shine on the stage” said Jan.

Analysis of the Finalists

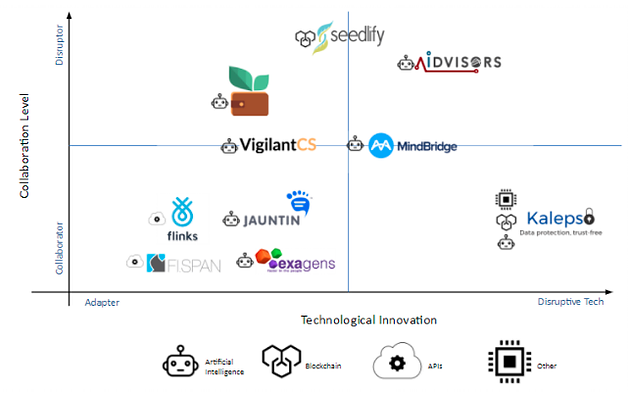

Level of Technology and Collaboration

A higher proportion of startups in the bottom half (collaborator) of the graph indicates that fintechs are moving away from the role of a disruptor. Furthermore, a bigger population on the left side (adapter) shows that startups are not always about deep tech, they can also use existing technologies to improve user and customer experience. Finally, given that Montreal is now considered as the hub for artificial intelligence, it comes as no surprise that 7 of the 10 startups had AI as their underlying technology.

Latest level of financing achieved

Half of the startups have already completed a seed round, raising close to $7 million! We would not be surprised to see other startups following the same league and raising more money in 2018.

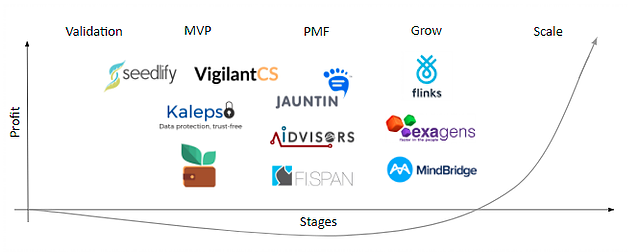

Each stage of the finalists

Whether you are an investor, fintech enthusiast or a potential future employee, it is always useful to identify the stages at which these startups currently exist. There was quite a range of Fintech’s that pitched during this year’s forum. Overall it was a mixed bag, with 1 startup in validation, 4 in minimum viable product (MVP), 4 in product-market-fit (PMF) and 3 looking to reach “scale” in the year 2018.

Each Team’s Pitch and Idea in a Nutshell

Below is a summary of the each of the team’s pitch, idea and other interesting stories that we thought our readers might enjoy.

Jauntin – Rainer Takahashi

Rainer Takahashi (below) presenting for Jauntin

Jauntin was the first to present. A startup that offers an on demand and usage based insurance service that can be turned on and off whenever you want. Not only that, Jauntin’s app uses geolocation to send notifications to users when they may need coverage. For instance, when a user steps into an airport, it’s very likely that they are leaving the country. Thus, the app sends them a travel insurance notification.

In February of 2017, Jauntin managed to beat 87 other Fintech ideas during the AIG Canada Innovation Challenge, ultimately inking a deal with AIG. Since then, they’ve convinced the president of Kanetix to join their advisory board, and developed several other proof of concepts (POCs) to serve high potential markets such as travel, freelance, and even the drone market. The secret behind obtaining POCs with such ease can be attributed to the gold mine of data that they can unlock for underwriters. One example being the real-time data on the whereabouts of an individual.

Seedlify -(now Corl)- Sam Kawtharani

Sam Kawtharanli (right) presenting for Seedlify

Next up was Seedlify, which provides loans for SaaS companies doing more than $50,000 in monthly revenues. Seedlify is a daring startup going for double disruption. Other than filling a vacuum created by traditional debt financing institutions that overlook SaaS companies even if they have a well diversified client base, it is also taking an ICO approach to raise money.

Even more interesting is the fact that Seedlify will use only 5% of the ICO money for itself, the remainder will be used to finance startups that it serves. ICO Investors, therefore, are like bondholders and can expect to make at least a 15% return. Another feature that makes Seedlify’s offering unique is the streamlined long filing process. Its backend simply plugs into the underlying startups accounting system and analyzes loan eligibility in real-time.

Flinks – Yves-Gabriel Leboeuf

Crowd’s choice Winners – Yves-Gabriel Leboeuf (Left), receiving their prize!

A startup with zero revenues in March 2017, but now looking to close the year with approximately $2 million in sales. Similar to a US-based startup, Yodlee, which was bought out for a $590 million in 2015. It is fair to say that Flinks is a rocketship.

They act as a data aggregator, an intermediary to connect fintechs with customer data held by banks thus, controls the flow of this data. Aggregating such data is advantageous, as the startup can use it to provide other intelligence based services in the future. And given that PSD2 is likely to come into Canada sooner rather than later, Finks may just just have to pivot.

Sprout Wallet – Tricia Jose

Tricia Jones presenting for Sprout Wallet

Tricia Jose is aiming to improve the cash flow management process for self-employed individuals, who face problems due to erratic and unpredictable payments schedules. A chat-based UI and tracking system will provide users with regular notifications and money management tips based on spending habits.

One may argue that Tricia is fighting in a crowded niche, but she is among the best storytellers and has articulated her positioning well to fill a gap in an underserved market. Moreover, Sprout Wallet can be a great conduit to tap into consumer data, which in turn can be used to create other offerings such as retirement planning, tax allocation and other concierge services.Her main challenge at this point in time, however, is to identify if clients will actually pay for such services.

Aidvisors – Luc Begnoche

Luc Begnoche (Right) With Peter Misek (Left), Partner at BDC and MC for the Pitch Competition

The average investor makes a 3-6% average return, miniscule compared to the 20%-30% return that big hedge funds and portfolio managers make . Aidvisors aims to change that, and in Luc Begnoche’s own words, “democratize artificial intelligence and finance.”

Aidvisors isn’t legally allowed to make investments on behalf of investors, but can provide recommendations for individuals to manage their portfolio. With 20 years of AI experience, Luc Begnoche builds millions of algorithms per stock, implements reinforcement learning to improve each algo, and then selects from the top 5% (those that outperform the market by +20%). Many are skeptical of his claims, which is why he offers services free of charge in the beginning. Later, a fee of $5 per algorithm per stock would be charged.

Kalepso – Georgios Depastas

Co-founders of Kalepso receiving their prize

TandemLaunch, a VC fund in Montreal, gave Kalepso $750,000 in seed money to move to Montreal and develop their world-class technology.

Kalepso has taken note of the financial sector paradox – all financial institutions want to operate in the cloud but can’t due to fear of data breaches. Using a combination of private keys, best-in-class encryptions and blockchain, this technology recipe is so advanced that it theoretically could protect against the security threat posed by quantum computing. The team officially launched this year and is confident of establishing POCs before year-end.

Exagens – Elisabeth Laett

Elisabeth Laett, stepping in last-minute, to represent Exagens

Unbeknownst to the crowd, Elisabeth Laett stepped in last-minute to pitch, as the other co-founder could not make it to the event due to unavoidable external circumstances. Despite this last-minute change, Elisabeth turned out to be among the best presenters of the evening.

Exagen’s, by offering conversation bot for users to engage with their bank, wants to bring back the personal banking touch that was ubiquitous before the development of online platforms. Desjardin used Exagens platform and achieved exceptional results. To be more specific, 3 million users holding over 100 million conversations. The startup began its operations 3 years ago and is now, on its way to make a total of 3 million in revenues, a figure which could grow exponentially given the successful metrics associated with their first pilot, which caused other banks to take note.

MindBridge – Eli Fath

Eli Fathi for MindBridge, making auditing sound interesting

Auditing may not sound fancy, but that does not mean that it is not rife with inefficiencies. Moreover, if one were to count internal and external audit with regulatory compliance, the potential size of the market would be close to $30 billion.

Mindbridge uses artificial intelligence to look for fraud in public markets. Simply connect your data sets and wait for the software to perform an analysis based on domain expertise and business rules, statistical methods, machine learning and cross correlation. In terms of numbers, Mindbridge has raised $4.3 million in seed, 10 customers, over $700,000 in revenues and is aiming for an IPO by 2021.

VigilantCS – Robert Kirwin

Robert Kirwin for Vigilant, did a great job selling his vision

Regtech, like auditing, is an unfancy industry. But, for Robert Kirwin who has 20 years of experience in compliance and is the Co-Founder & CEO of VigilanteCS, compliance risk is a $11.5 billion opportunity.

Compliance staff spends only 20% of its time analyzing data, the rest is spent on collecting and organizing data it. Organizations have +5 siloes of compliance data. Going through all this data, based on samples, is like searching for needles in haystacks. Vigilant centralizes all this work in one area, and sifts through the entire data pool to look for abnormalities. At this point in time, the startup is still developing its tech and pilot testing. But once that part is done, it can potentially charge +6 figures/per client for its services.

FI Span – Clayton Weir

Clayton Weir, talking about this startup FI Span

Acting as an intermediary between fintechs and banks, FI Span curates and integrates 3rd party fintech solutions into the bank’s system. Their hook, “allowing banks to act like fintechs.” They serve as a hub for fintech and thus, facilitate the exchange of data, while earning substantial service fees from their corporate clients. The team has ample entrepreneurial experience and has raised close to $2 million in seed round. FI Span already has 6 fintechs on it’s simple yet powerful platform, with another 15 to be added in the future. On the other side, one financial institution is beta-testing the platform, with another 3 in the pipeline.

Conclusion – The Winners

All startups put in a lot of effort and did an incredible job, but unfortunately, the judges had to pick a winner among the group. Kalepso was picked as the winner by the judges because of their product and vision, whereas Flinks was the crowd’s favorite for their impressive metrics and exponential growth. In the end, both ended up sharing the grand prize of $10,000.

Congratulations once again to every team!

Check out Finance Montreal’s re-cap video of the 2 amazing days we all shared at the Fintech Forum. See you next year!