Interview with Kristine Beese from Untangle Money by Kristi Carignan

———————————

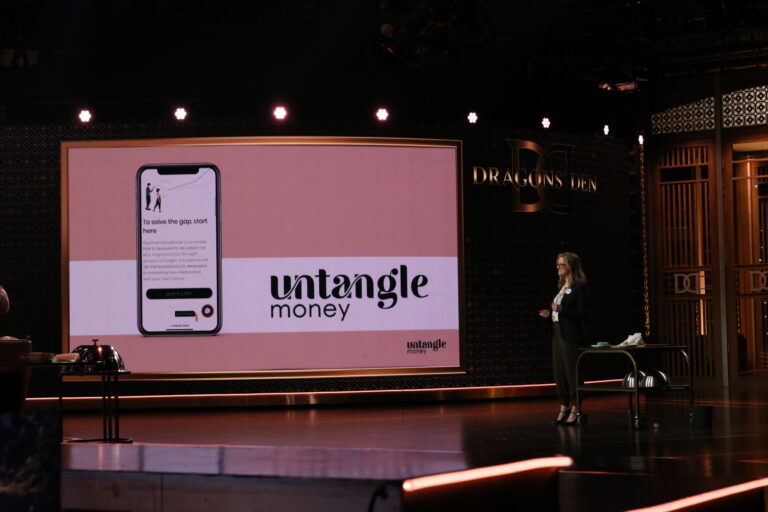

Untangle Money: Revolutionizing Financial Planning for Canadian Women

Discover an innovative financial planning solution that helps middle-income Canadian women make realistic plans for their future.

What Makes Untangle Money Special?

Untangle Money was created to make financial success accessible and sustainable for more of us; to put security and independence in our hands. We help Canadian women better understand their money and make realistic plans for their future.

What plans? That depends on your goals. We help you plan not for ‘the’ future, but for ‘your’ future. We show you the changes and decisions you have to make now to ensure that you are exactly where you need to be in 2 years, 3 years, 5 years and even 10 years’ time.

We offer our services to individuals, to startups and to established businesses. One of our favourite things is to speak to groups of employees and encourage them to learn about money, and actively chose the future that is best for them.

What does Untangle Money offer that no one else has?

Our latest offering, one we’re really excited about, is called Untangle AUTO. AUTO is a no-touch solution that puts the power of our Untangle MINI financial planning solution to work for you, in the comfort of your own home, 24 hours a day. Within the next four years, we expect more than 1 million women throughout Canada to be enabled and empowered by Untangle AUTO.

But I’m not in a place where I can make use of financial planning – maybe in a few years…

That’s where you’re wrong. Untangle Money was developed for middle-income Canadian women just like you – women who didn’t think they were in a position to benefit from financial planning of any kind, and who thought they were still years and years away from the success they want and deserve. Small changes make a big difference. Find out more today!

Do women really need their own financial solutions? Money is money, right?

Money is money, but sadly men and women couldn’t be more different when it comes to earnings potential – nor could the career trajectories of middle-class Canadian men and women. Statistically speaking, men at retirement age have earned $1 million more in earnings than women, on average. Why the disparity? All the reasons you think. But also, because people think that financial strategies designed for wealthy men work just as well for middle-income women.

But what would I actually be doing differently? I can’t make money from the air.

No, Untangle Money is no Rumpelstiltskin, creating gold in the basement while you live your life. If you want the kind of retirement you deserve, you’ll have to put in the work and make a few short term choices. What Untangle Money can do is offer you the support and guidance you need to be confident, be consistent, and do the work necessary to retire comfortably and happily.

It is not magic. It is wisdom. Wisdom gathered the hard way, by women like you, who want to make the path just a little easier for women like them.

And does it actually work?

Actually, it does. We see a 30% reduction in the financial anxiety of the women we work with. All of our financial mentors have real world experience, and are here to share that knowledge with you. They understand that your path is unique, and they have important ideas to share. Ideas that can change your life, ideas you can put to work for you today.

With its latest fully-automated offering, Untangle Auto, Untangle Money is empowering women throughout Canada to take control of their financial futures and achieve the success they deserve. For more information on Untangle Money and what it can do for you, check out their website.

Fintech Hub & Fintech Cadence impact

"Fintech Cadence and the Fintech Hub have had a tremendous impact both on me, as a Founder, and on Untangle Money, as a company. When you are surrounded by companies, mentors and subject matter experts, who all have a deep understanding of a particular start-up space, in this case Fintech, everything is a bit tighter." Kristine Beese