What Do We Mean By Payments?

On the surface, a payment appears to be a straightforward process. The buyer pays the merchant and money is transferred from one party to the other. But this flow holds true only for cash payments. For all other payments, the process is much more complicated. In most cases, there are more than two parties involved in a transaction. In fact, a credit card transaction involves four parties – the purchaser, the seller, the issuing bank, and the acquiring bank.

Moreover, payments can be classified into two separate categories based on the type of transaction: exchanging & provisioning. Exchanging is where cash and coins are involved, whereas provisioning is when a third party is involved (e.g. Mastercard, Visa). Many feel that the current payments structure, especially when it comes to provisioning is overly layered. In an ideal world, where the payment process is as efficient as possible, all payments would be akin to an exchange – even those done electronically. Such an ideal world, as would be discussed later, could be closer than one might imagine.

Is the Canadian Banking Environment Conducive for Fintech Innovations?

Guy Dartigues, a payments expert with more than 20 years in the industry and currently working for Desjardins, believes that Canada offers the perfect balance between the restrictions provided by regulations and freedom that comes with capitalism.

Guy Dartigues (Right) with Ilias Benjelloun (Middle) and Layial El-Hadi (Left) at FormFintech’s Formathon 2017

The same, however, is not true south of the border. The US has approximately 6,000 financial institutions (i.e. FIs) as compared to a handful in Canada. One would expect there to be more competition among US FIs and thus, more innovation. Moreover, a fragmented banking sector is easier to “game” for fraudsters. One might conclude that these factors would lead to a better business case for the adoption of chip payments in the US. Yet, the contrary has been true – US banks have struggled to adapt a chip payment system.

Any new innovation in the payments space requires enough traction and support to attain mass adoption. For innovation of this scale across the banking sector, collaboration is needed. In simpler terms, a fragmented banking structure with multiple players can have a pernicious effect when it comes to innovations in payments.

Canada, with it’s tight knit group of banks creates the perfect environment for the mass adoption of a new payments system, as it is easy for the banks to communicate and get buy-in from each other.

Not All Is Wine And Roses…

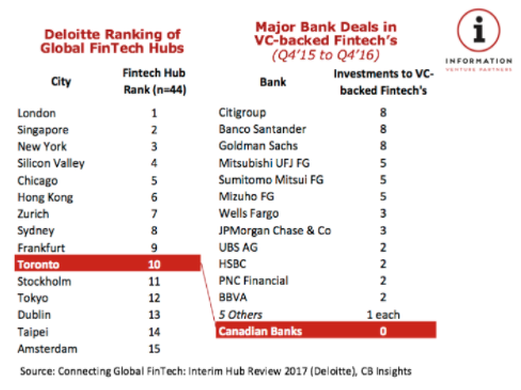

However, when it comes to innovations in the the Canadian banking system in general, a bowling ball analogy is quite apt. Once a bowling ball gains momentum changing course becomes almost impossible, a less than ideal situation in world of startups. Also, fintech startups are leading to erosion of power for banks. Based on a report published by McKinsey & Co: “…banks could lose as much as 60 per cent of the profits and 40 per cent of revenue from their retail arms to financial technology or FinTech start-ups within the next decade.” Canadian banks are behind the eight-ball in this arena as compared to the rest of the world, evident from a study done CB Insights and Deloitte, as they were involved in zero major fintech deals, even though a Canadian City (Toronto) is ranked among the top 10 fintech hubs in the world.

Ranking of Fintech Hubs and Ranking of Banks Based on Fintech Deals

Things Are Starting To Change

However, Banks are starting to understand the importance of innovations and working with startups, incubators and innovators across the sphere. Bank of Montreal is working with Ryerson University’s Digital Media Zone, TD is sourcing talent by investing in Waterloo’s Communitech and Scotiabank has its own fintech incubator, Digital Factory. Guy states that “working with an external incubator allows one to escape the clutches of an invisible framework that is present at all organizations – a key component when it comes to navigating the innovations world – leading to solutions that internal teams cannot provide.” Toronto’s largest incubator collective, the MaRS Fintech Cluster is the amalgamation of efforts of 12 domestic and international players which include CIBC, Interac, PayPal,Information Venture Partners, Tangerine, Ingenico, American Express, Square, Moneris, TMX, Ugo and Manulife.

In Montreal, FormFintech collaborated with Desjarins during the first Formathon to develop a payments solution for making donations on-the-go. A young group of astute and passionate students from Concordia University took up this challenge. They used the first principles method of design thinking and lean-startup, while focusing on the core-tenants of what makes a better payments solution – intuitivity, security, cost-efficiency and speed. The team, called Mezana, received regular support from Desjardins in the form of expertise, salary and moral support – critical yet underplayed in the startups world. Following the Formathon and the 3-month innovations project in which the team further refined their idea, Mezana is currently in the process of prototyping and testing their solution on a mass scale, with the goal of attracting,orienting and educating consumers about this new innovation.

Montreal, Home to 14 Payments Startups Creating 3500+ Jobs

Mezana is among the many startups in Montreal, trying to decode the nuances of the payments space. Numerous others are active is each of the payment sub-categories of consumer payment services, merchant payment services, new payment types and infrastructure and ancillary services. In fact, payments is largest fintech category in Montreal, accounting for over 25% of fintech startups and three-fourths of the jobs created.

Desjardins’ Payments Mandate Winning Team with Desjardins Executives at FornFitech’s Formathon 2017

Of these, organizations in the merchant payment services category such as Lightspeed, Pivotal Payments and Paysafe are among the largest and have created close to 3500+ jobs on a global scale, with approximately 1000 of within Canada.

Hottest 3 Payments Sub-Categories in Montreal

Cryptocurrencies (Blockchain): When it comes to the hottest sector, or rather the one creating the maximum buzz, cryptocurrency takes the top spot. Two companies in particular, Shakepay and Instancoin, are making forays in cryptocurrency-payments hybrid category. The former provides a VISA debit card for Bitcoin spending, whereas the latter supplies Bitcoin ATMs and transfer terminals.

Mobile Wallets: In the mobile wallets category, giants such as Apple and Google have already captured a big chunk of the market. But innovations continue when it comes to using a mobile phone to make payments. For instance, Secunik, a mobile app, allows the residents of Drummondville (Quebec) to pay parking fees with their phones.

In a somewhat similar reign, PaymentPin provides consumers with the option to charge purchases to their landline and mobile phone bills – a solution that adds new revenue streams for merchants and provides convenience for consumers.

Ancillary Services: The Payments sector is unique, in that a single transaction causes a ripple effect, requiring numerous ancillary services to support the process. For startup entrepreneurs, this serves as another avenue to enter the market. Instead of taking a blurred approach, trying to capture the entire market of payments, these firms realize that it’s better to serve a subsector. Ancillary services may include automated billing, end-to-end agreement automation and cash-flow management tools. Nukern, Dealflo and Kiwili are 3 startups that provide such services.

In a few cases, entrepreneurs are exploiting a niche within these subsectors. For instance, Otonom Solutions provides an automated payments solution for landlords and tenants. Domum link allows landlords to track activities of their building such as vacancies, repairs and complaints, along with accepting payments.

However, for most of these startups the challenge still remains, they need to achieve mass adoption for their solutions would eventually cement their market share.

Can We Call This Innovation?

Even though, the payments space has been on fire for the past few years, most experts believe that there isn’t any “real innovation taking place.” Consumers now have the convenience to pay with their phones instead of a card, but the underlying mechanism and parties involved remain the same, which at times can be considered as a redundant number.

The existing Payment Rails were built with the purpose to serve large transactions, requiring an impeccable security system akin to a Fort Knox where each block of gold is tracked. As a result, the time required to initiate and authorize a transaction required rigorous security measures. All these measures cause the price of a transaction to go up considerably, something which in today’s world, is irking both customers and merchants alike. Simply put, there is vacuum in the market abhors a vacuum.

Additionally, for robust innovations to take place, the underlying technologies would have to be capable enough to support an entire payments system built from scratch. Ideally, it would be adept at reducing the number of players in a single transaction.

Can Blockchain Make a Big(ger) Difference?

At first impulse, blockchain seems to the be ideal technology for an efficient payments system. . But one needs to be careful, as the word blockchain has been muddled with other terms. Upon further inspection, one would understand that blockchain is just a part of the bigger technology known as Distributed Ledger Technology (DLT), which can be further divided into permission and permissionless ledgers, shared and federated ledgers, public and private ledgers etc.

Shared ledgers is likely to be the more robust technology in the coming years due to three main characteristics – disintermediation of trust, immutable record and smart contracts – equipping payments services providers with real technology that can replace legacy systems.

What’s more, DLT in its various forms does not suffer the flaws of blockchain and Bitcoin – one of the biggest being scaling – which are behemoth obstacles for mass adoption. For instance, VisaNet is capable of processing 56,000 transactions a second, whereas Blockchain’s limited size of 1 MB/block size allows it to complete only 3 transactions per second – not suitable for mass scale adoption.

In clearing and settlement, DLT could smooth the way for a more efficient system to replace the current 4-party payment network. However, such a system would be a blockchain layer over the currently existing payments network. Among the many benefits of the such a system would be the elimination of file reconciliations, fewer delays due to inconsistencies and improvements in speed. All these improvements would ultimately translate into reduced costs for payment networks and card issuers, cost savings that could then be passed onto the consumer.

Is There Room For Artificial Intelligence?

Nowadays, no tech related discussion is complete without the mention of Artificial Intelligence. Boiled down to its very essence, artificial intelligence can be advantageous in all scenarios that require processing data or requiring automatic perception and reaction to certain situations. The payments space is ripe with such opportunities, with numerous players already exploring a plethora of areas.

One such prominent example is that of machine learning in fraud detection,which uses machines to analyze data, detect patterns and match those against pre-specified fraud models. As more data is collected, the machine “teaches itself” to better detect frauds. Tools such as fingerprinting, behavioral analytics, proxy filtering, and geolocation can be used to identify high risk transactions.

Artificial intelligence, like DLT, is being used as a blanket term for a number of sub-technologies. A branch of AI that has it’s own use is Vision Recognition, which can be applied to mobile payments, protecting consumers from fraud at the point-of -sale (POS). Fingerprinting and facial recognition are a couple of examples of this technology.

Natural language processing (NLP) and chatbots are also AI sub-branches with important payments applications. Chatbots are important when it comes to handling daily mundane customer inquiries, and NLP is appropriate for voice-enabled devices such as Google’s Siri and Amazon’s Alexa, allowing consumers to conduct voice-based transactions.

So, What’s The Future?

Payments is among the most heavily invested category within Fintech. In 2016, payments startups attracted huge amounts of financing – 40% of the total funds invested in fintechs. According to Global Opportunity Analysis and Industry Forecast (2014-2022) the global mobile payments market is estimated to reach $3,388 billion by 2022, growing at a CAGR of 33.4% from 2016-2022, implying that investments in payments startups would continue to be formidable in the coming years.

Like all innovations, changing consumer needs and preferences are the driving forces in this industry. Everyone wants payments to be as frictionless, seamless and fast as possible. According to Mastercard, “The wave of social engagement we see every time new payment innovations are rolled out truly reflects the demand and desire for new and more convenient ways to pay. It also shows that payments have really moved into the heart of the shopping experience – causing frustration when not accepted and engagement when fast, easy and personal.

It is, thus, fair to say that the future of payments is going to faster and possibly omni-channel – equipping consumers who browse across multiple outlets and channels to make payments seamlessly. Startups that aim to create a such a cohesive experience will likely emerge as winners.

Canada, as compared to the rest of the world, has a lot of catching-up to do. But recent events and efforts pertaining to collaboration among various players would eventually help the nation to become a force to reckon with. We have the robust banking system in the world, now, it’s just a matter of making it the most innovative.